Three Issues

- Accounting Issues: Audit queries, data anomalies

- Budget Issues: Transparency, credibility

- Economic issues: Impact, viability, fiscal responsibility, sustainability

Accounting, Financial Management Anomalies

Audit Queries

Proceeds of US$ 2 b issue credited to GOK offshore account towards end June 2014.

First draw downs on July 3 2014 (syndicated loan US$ 604m (Ksh. 53b), transfer to budget US$ 394m (Ksh.35b)).

The loan repayment is reflected in FY2014/15, the transfer is reflected in FY2013/14 yet the two transactions took place on the same day.

“This is an anomaly in ACCOUNTING TERMS because it breaks the fundamental accounting and financial management principal of matching revenues and expenses that requires that money received and spent must be accounted for in the financial year to which they belong” (Auditor General Letter to Treasury PS dated 24 Oct 2014)

Three Eurobond Accounts

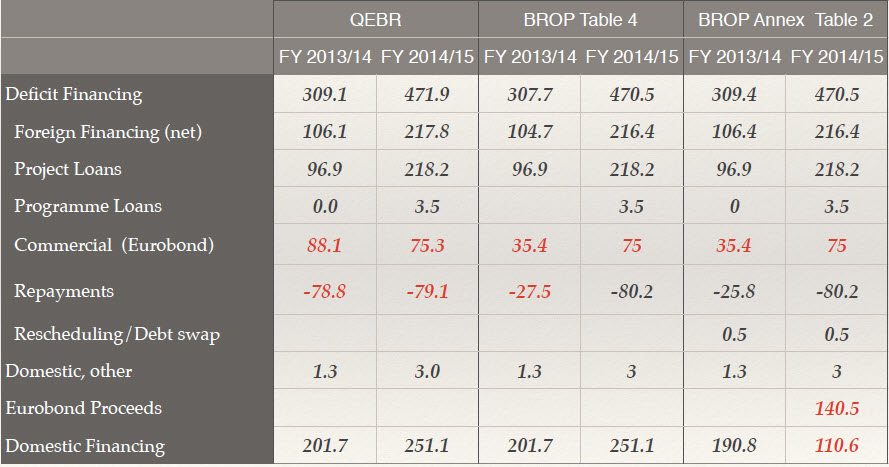

- Quarterly Economic and Budget Review (QEBR) QIV 2014/15: External commercial financing of 88 billion and Ksh. 75 billion in FY 2013/14 and FY 2014/15 respectively total Ksh. 163 billion, Ksh. 87 billion less than total proceeds. External loan repayments (principal) of Ksh. 78.8 b and Ksh. 79.1 billion in the two FYs— appears to be double counting of syndicated loan repayment (see Table on next slide, entries referred to highlighted in red)

- Budget Review and Outlook Paper (BROP) Table 4: External commercial financing of 35 billion in FY2013/14 and Ksh. 75 billion in 2014/15. This totals Ksh. 110 billion, Ksh. 140 billion less than Eurobond proceeds. FY2013/14 external debt repayment adjusted downwards by Ksh. 51.3b to Ksh. 27.5b—difference close to syndicated loan repayment figure.

- BROP Annex Table 2: In 2015, the proceeds appear in two different lines, Ksh. 75 billion as external commercial financing and Ksh. 140.5 billion as “Eurobond Proceeds” totalling Ksh. 251 billion. Domestic financing adjusted downwards from Ksh. 251b to Ksh. 110 Treasury explanation is that Eurobond bank deposits carried over from FY2013/14 (Ksh. 140.5 billion) is accounted for as domestic financing (private conversation with PS). Even if that is the case, CBK data shows net borrowing from commercial bank/non bank public totalling Ksh. 132 b not Ksh. 110b. Where is Ksh. 22 billion? This is also odd since the amount has not entered the government accounts anywhere else as a foreign borrowing.

Budget transparency, credibility

Reporting

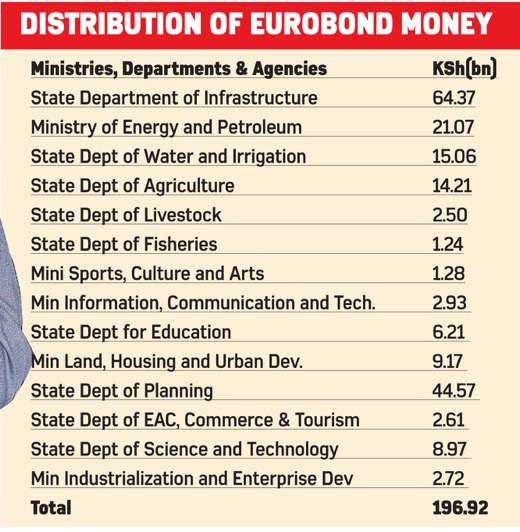

The only reporting of the use of Eurobond proceeds is the schedule of allocations tabled in parliament by the CS Treasury. It shows that all the proceeds exhaustively allocated. The Government is reluctant or unable to provide information on the projects funded. In its press release dated 3rd December, the Treasury states:

“It is important to note that the development budget for the financial year 2013/14 and 2014/15 was appropriated by Parliament at the program level as provided for under Section 12 of the Second Schedule of the Public Finance Management Act, 2012 and therefore information on the specific development projects implemented by the fourteen MDA’s that were funded from the proceeds of the Sovereign Bond in available in the specific MDA’s. This information is being collated for posting in National Treasury Website www.treasury.go.ke as well as publication and publishing.” (emphasis ours)

Does the fact that budget is approved at the programme level mean that Treasury does not scrutinise the specific projects that make up the programme? The Government has a monitoring and evaluation function (M & E)—we would expect that there is a live database of the implementation status of development programmes and projects. For the Treasury to disburse a huge external loan, the biggest ever, without expenditure tracking seems downright irresponsible.

It is noteworthy that the Treasury only provided this information upon being summoned by parliament. Zambia and Ghana have provided simple but comprehensive reporting on how they have used their Eurobond proceeds (see next slides)

Eurobond Reporting : Kenya

Eurobond Reporting: Zambia

UPDATE ON USAGE OF THE US$ 750 MILLION SOVEREIGN BOND

Lusaka, Monday, 28th April, 2014. Zambia’s Sovereign Bonds issued in the international capital markets are performing to markets expectations. Performance of the US$ 750 Million Bond [Issued in September, 2012] – The US$750 Million Bond, which was issued in September 2012 at a yield rate of 5.365% has strengthened over the past one month from a yield of 8.4 % to the 7.44% currently. It is important to note that yield rates fluctuate according to market conditions. This bond is due in 2022. Below are some highlights on the usage of the USD 750 Million Bond as at 31st March, 2014;

- Kafue Gorge Lower Power Project [ZESCO]: US$186 Million was allocated for this ZESCO is making progress towards implementation of the project. So far, 5, 834 Hectares of land which lies in Senior Chieftainess Nkhomeshya’s area has been secured. The application for title deeds for the entire 11, 563 Hectares of land which is required for the project is awaiting receipt of consent letters from two other Chiefs. Major infrastructure for resettlement of displaced persons has been completed and awaits hand-over. In addition, work towards preparation of a Project Feasibility Study Report by Lahmeyer International GmbH of Germany has advanced.

- Power Distribution Project [ZESCO]: US$69 Million was allocated for this From the 30 lots under the Power Distribution Project, a total of 12 contracts have been signed while contracts for 10 projects are at various stages of tender. Contracts for 8 projects are yet to go for tender. From the 12 signed contracts, 8 sites have been handed over to contractors and works are ongoing, with the most advanced project at 60% completion.

- Zambia Railways Limited: Out of the US$ 120 Million allocated to Zambia Railways, progress has been made in the procurement of infrastructure rehabilitation materials, rolling stock, and acquisition of track rehabilitation and maintenance services. 32 track contractors have so far been engaged to undertake track rehabilitation This has resulted in the creation of more than 4, 000 jobs.

- Development Bank of Zambia [DBZ]: The allocation from the US$ 750 Million to DBZ was US$20 Million. DBZ has so far made commitments and disbursements for a total of 25 Small Medium The total amount committed and disbursed to date is US$ 10.3 Million.

- Ministry of Health: US$ 29 Million was allocated to the health sector for modernisation of the University Teaching Hospital, Livingstone General Hospital, Kitwe General Hospital, and Ndola General Structural modernisation works have commenced at the UTH, including reconstruction of the Filter Clinic [Adult Medical Emergency Unit]. The process of tendering and service procurement among the other beneficiary hospitals is progressing well. Bond proceeds allocated to the health sector were also targeted at procurement of specialised equipment for theatre, prosthetics, orthotics, blood transfusion etc.

- Road Sector: The road sector was allocated US$310 Million of which US$145 Million has been used to repay funds borrowed by the Government for the Lusaka Urban Roads Project [Formula 1] prior to the 2011 general elections. The balance of US$165 Million is for on-going various road maintenance and upgrading works; the Kitwe-Chingola dual carriage way project; and the link Zambia 8000 programme. Different projects are at different levels of positive

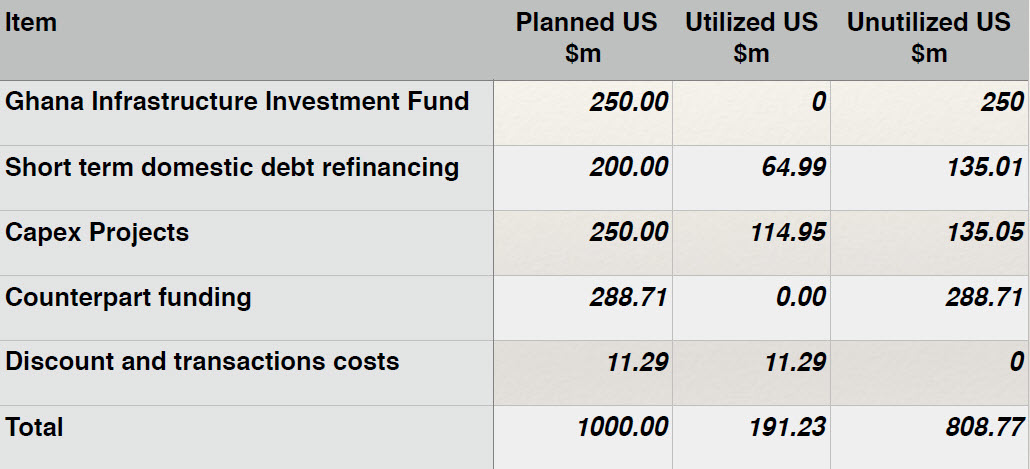

Eurobond Reporting: Ghana

Budget Transparency, credibility

What did it Finance?

- National Government budgeted Ksh. 271b for 51 priority development projects in FY 2014/15, of which Ksh. 157b is SGR leaving Ksh. 114b other This include everything from rural electrification, to law courts to the infamous laptops, almost all are aid funded. Donors disbursed Ksh. 126b (Ksh.98b loans, Ksh. 28b grants)—more than the funding of all of them.

- Is it really possible that the National Government to have absorbed Ksh. 170 b (Ksh. 251 “net domestic financing” inclusive of 251 billion less Ksh. 80b ext. loan repayment) in other national development projects? Which projects are these? Where are they?

- why would we spend more money on “non-priority” projects than priority

- Does this explain the low absorption of external funds?

- How were these funds absorbed while at the same time accumulating pending bills? (road contractors were owed Ksh. 25 billion by October)

- 35b Eurobond financing vs Ksh. 25 b reflected in FY 2013/14 budget. Where is Ksh. 10b? Why was the expenditure backdated. If pending bills, what harm to be transparent and reflect them as paid in FY2014/15? The Treasury’s press release of 3rd December dates the transaction on 30th June. Why lie?

- “Another fiscal responsibility principle requires that the national government’s borrowings be used only for the purpose of financing development expenditure and not for recurrent This principle continues to be adhered to by the government…” (BROP, September 2015).

- Is this assertion credible in the light of the Government’s aggressive international and domestic borrowing in this quarter?

Economic Issues

- Objectives of Eurobond

- macroeconomic stability: lower domestic interest, stable currency, reduce inflationary pressure

- repay Syndicated loan, diversify Government borrowing

- provide benchmark for private international borrowing

What have we achieved?

- Shilling more resilient than other currencies, but this has required aggressive defence (selling dollars and high interest rates)

- Interest rate spike in October was only staunched by another unplanned syndicated loan (US$ 750). This money will soon run out. What next? Another one?

- Low interest rate objective not Despite the Eurobond, the Government’s domestic interest costs rose from Ksh. 119b in FY2013/14 to Ksh. 139b in 2014/15

But where is the Economic Impact?

• Government/World Bank estimates SGR construction adding one percentage point to GDP growth. Eurobond injected more money than SGR into the economy in FY 2014/15, so both Eurobond and SGR should have increased growth by at least two percentage points. But growth did not accelerate at all (5.1 in FY 2013/14, 5.3 in FY2014/15

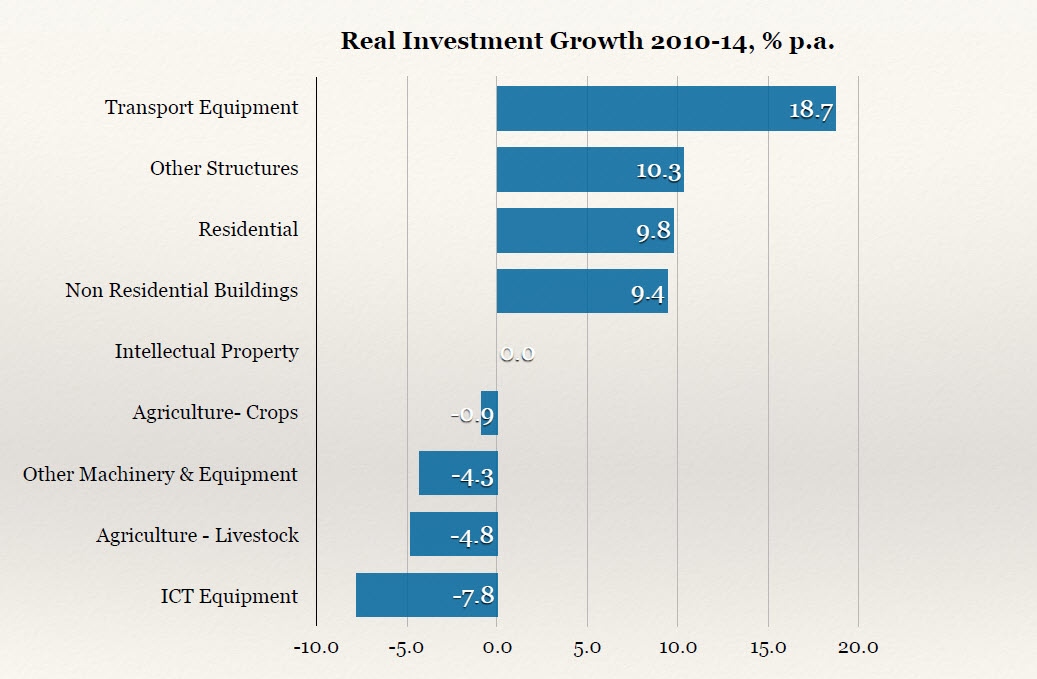

- Public investment, infrastructure in particular, is not of itself productive It is supposed to crowd in private productive investment—factories, farms, hotels etc. Instead of “crowding in” private investment, the infrastructure investment seems to be “crowding out” productive investment (see chart on next slide)

- The “crowding out” may also explain the reason why tax revenues have flatlined— if private sector is not increasing productive investment, then the tax base of the economy is not

Real Investment Growth 2010-14, % p.a.

Fiscal responsibility, sustainability

- Initial Eurobond plan was to issue USD 500 million benchmarking bond which would have paid off the syndicated This was escalated to US$ 1.5 billion because the market was receptive to African sovereign bonds, then to US$ 2 billion. Success of issue prompted “tap sales” of US$ 750m.

- This escalation happened despite there being no stated intention to increase borrowing, only to “diversify sources”. Who made these decisions? What was parliament doing?

- Expenditure is “sticky downwards.” Government budgeting is incremental—once you increase it, it is very difficult (politically) to go The result of this unplanned borrowing is a “structural deficit” that we have to fund every year.

- We are already seeing the consequences. Government borrowing is back up to pre- Eurobond levels, the US$ 750 unplanned syndicated loans, plans to issue another Eurobond next.

Kenyans for Peace with Truth and Justice (KPTJ)

Kenyans for Peace with Truth and Justice (KPTJ)